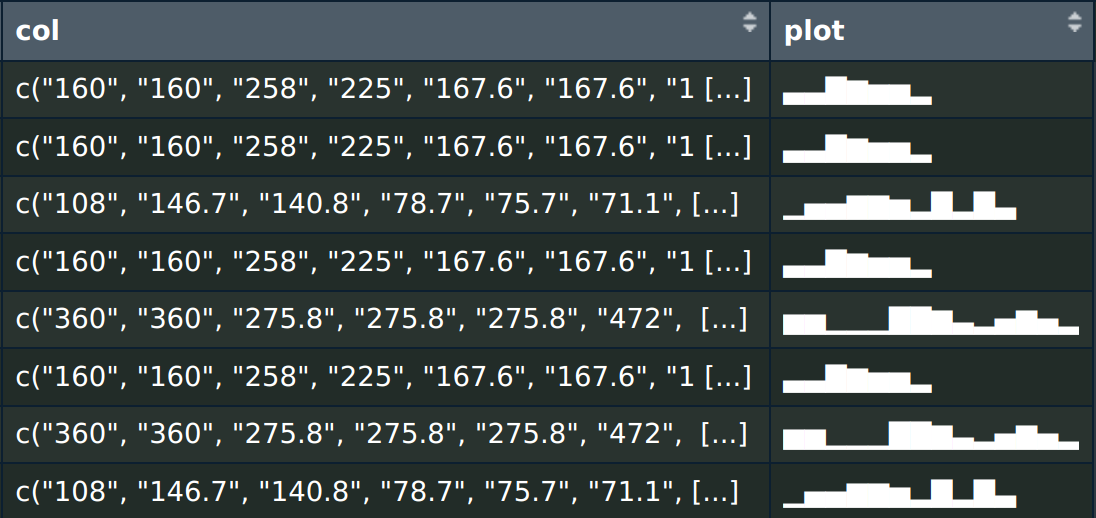

Charting Data Differently: Text-Based Visualizations in R

In our love affair with ggplot2, we might sometimes overlook a simpler approach: creating ASCII plots directly in a data.table.

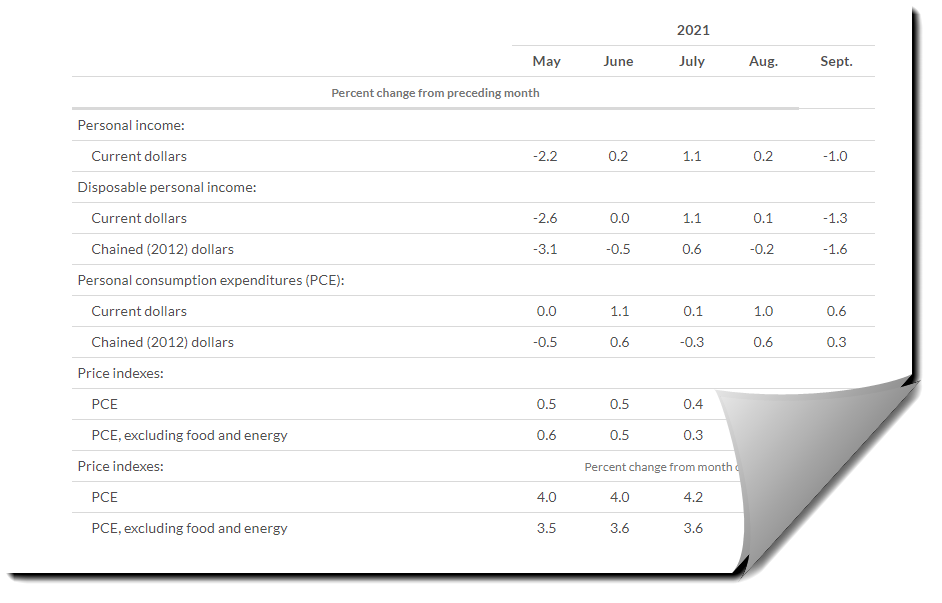

Theory #4: The US Balance of Trade Explained

During the recent US election, the concept of the balance of trade was bounced around a lot, but not always used in the correct manner. This is due to a combination of politics and ignorance, and can be cured by understanding exactly how the balance of trade works.

Investing: ETF Asset Allocation Strategies Explained

ETFs have sky-rocketed in popularity in the last few decades, making them the go-to asset class for investing. They are easy to understand, are able to follow a broad selection of market securities, and come with very low management fees.

Overview: Leading, lagging, and coincident economic indicators

Markets are constantly looking for signs that indicate that the current economic climate is about to change. Those signs are usually provided by economic indicators which are regularly reported and closely followed by traders and investors around the world.

Theory #3: Understanding the Efficient Market Hypothesis

In financial economics, there is a heated debate among academics over whether it’s possible to generate excess returns above the average market return. Because, if a group of traders or investors is able to outperform the general market, that market couldn’t be described as efficient.

The Chinese renminbi: On its way to free-float

Almost seven years have passed since June 2010, when China’s government indicated it would continue with financial reforms and make the renminbi exchange rate more flexible, satisfying major world economies and their leaders who believed the renminbi is excessively undervalued.

Portfolio #1: Calculating the Federal Reserve rate change probability using Fed Funds futures

Calculating the Federal Reserve rate change probability using Fed Funds futures